26th October 2020The Chancellor’s latest support scheme – an FAQ

The latest Government measures come just weeks after the Chancellor’s Winter Economy Plan and Extension to the Job Support Scheme. With the support available in a constant state of flux, it can be difficult to keep up with the latest measures. We have put together a simplified FAQ of what the latest measures mean and how you can benefit from them.

If you would like to have an extended discussion about your own circumstances, get in touch – our partners are here to support you through these challenging times.

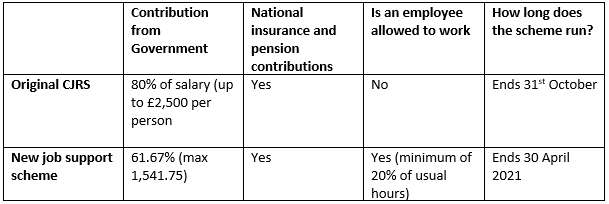

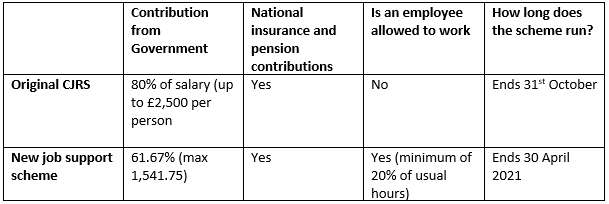

What are the differences between the latest Job Support Scheme and the previous support packages (inc. CJRS)?

There are a number of key differences, both in terms of how much Government and Employers will have to pay towards employee salaries.

How much will business owners be expected to contribute to salaries, and who is eligible for government assistance?

- An employee working at least 20% of their usual hours will be eligible. This was changed in the recent announcement. The earlier announcement stated that to be eligible, an employee had to work a minimum of a third of their usual hours.

- Employers will be required to pay the following:

- 100% of hours worked, (min 20%)

- 5% of the employee’s gross salary for the time not worked, (capped at £125 per month)

- All national insurance and pension contributions, including the amounts due on the Government’s contribution to the employee.

- The employer can top-up at their discretion.

- Employers can only claim for individuals who were employed between 6 April 2019 and 23 Sept 2020. If employees left after this date and were then rehired, then they are also eligible under this new scheme.

- Employees earning £37,500 per annum or less will receive at least 73% of their normal wages, however an employee earning more than £37,500 will be restricted due to the caps in place, e.g. an employee on £50,000 will receive 40% of their normal wages.

I am self-employed – what assistance am I eligible for under the new package?

- From 1st November to 31st January 2021, self-employed individuals will be entitled to 40% of three months of their average profits, (up to a grant of £3,750).

- For this grant, you must show that your business has been affected by a reduced demand.

- The grants are taxable and subject to national insurance.

- Other criteria for self-employed individuals follow the earlier two grants available this year, including:

- Average trading must be less than £50k per year

- You must have filed a tax return for 2018/19

- 50% or more of your total income comes from self-employment.

- Another grant will be available from 1st Feb 2021 to 30th April 2021, but details are yet to be announced.

Company directors are ineligible for the SEISS grant. Is there any support eligible for them?

- Once again, company directors on minimal salary and receiving the majority of their remuneration through dividends are left with little support.

Is the assistance I’m eligible for dependent on tiering? Is there a different level of support available if my business is in a Tier 2 or 3 location as opposed to Tier 1?

- Employees working for employers who are legally required to close their premises will receive two-thirds of their normal pay, (capped at £2,083.33 per month).

- Employers will have discretion to top-this up.

What other forms of assistance can my business receive?

- Employers will be entitled to a £1,000 retention bonus from the Government for those employees who were furloughed and are still in employment at 31 January 2021.

- Tax relief for expenses incurred while working from home.

For more information or advice, reach out to our team.