Recently I had the pleasure to present with Simon Warner (Head of Licencing and Ventures at Oxford University Innovation) and Carol Rudge (Head of Higher Education at HW Fisher LLP) as part of the BUFDG “Finance Festival”.

The topic of our talk was tech transfer and the commercialisation of Intellectual Property (IP) by universities and similar research institutions.

Broadly the areas discussed as part of the presentation were: (i) the negotiation of key clauses in a Licensing Agreement, (ii) the Royalty Reporting process, and (iii) the key considerations for an effective royalty audit programme.

The “Net Sales” clause

The Net Sales (or Net Revenues) clause can be under-considered from an accounting definition perspective in an IP agreement. This is in total contrast to the exactitude of language used to protect those IP rights on behalf of the University. Where significant thought is often applied to the percentage Royalty Rate, we find it surprising how little attention this clause receives – discounts and deductions between gross and net revenue can easily total 20%, and yet the focus on what is deductible under a Net Sales clause is often poorly defined. Surprising because the effect on how much the University then receives in return for the commercial exploitation of its valuable IP can be huge.

In our presentation we discussed some of the key areas for clarification: such as carefully defining invoiced revenue, restricting discounts and allowances, and certain discounts that are typically not allowable under an agreement. We also discussed how to future proof agreements with reference to “other exploitation” of the IP. The classic example of this is eBooks under publishing agreements between authors and publishers – no one expected this distribution model prior to the millennium, and many agreements simply weren’t set up for dealing with something new. Another example we have seen is where a standalone patent/IP is then subsequently exploited as part of a component with additional and independent patents, where the basis of apportionment of revenue between them has not been properly defined.

The royalty reporting process

Managing one or two licensees may seem easy at first, but the number of action points can quickly escalate, to the point that even managing 6-7 licensees quarterly can be a logistical challenge. As your portfolio grows, you will need to find new ways to automate and track the progress of your licensees.

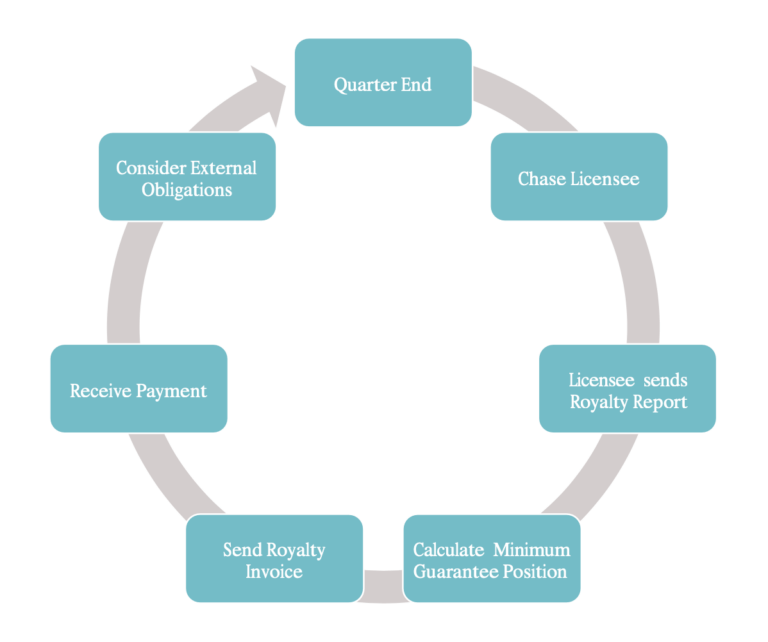

We’ve included our summary of the process below (which is typically performed quarterly):

The truth is that some licensees will be timely and accurate each quarter, whereas others will require chasing. Your finance team will also need to ensure that they are keeping on top of the reports and invoicing the royalty reporting (and milestones) in a timely manner. Your team will probably spot other issues along the way such as Withholding Tax (WHT) deductions, new reporting templates, errors in the calculations and currency exchange issues.

Finally, it’s possible you will have other obligations to third parties who helped fund or develop the IP. This might also include the academics, who are often incentivised to think commercially, by enjoying a participation in the successful commercialisation of IP.

The benefits of a royalty audit programme

We work with Licensors across a wide range of industries to provide the assurance that the royalties are reported accurately. Whereas it is quite unusual to identify deliberate misstatement of royalties, it is extremely common to find errors and omissions when reviewing the detailed data upon which the statements were based. In fact, we find that over 90% of Licensee audits result in an underpayment to the Licensor.

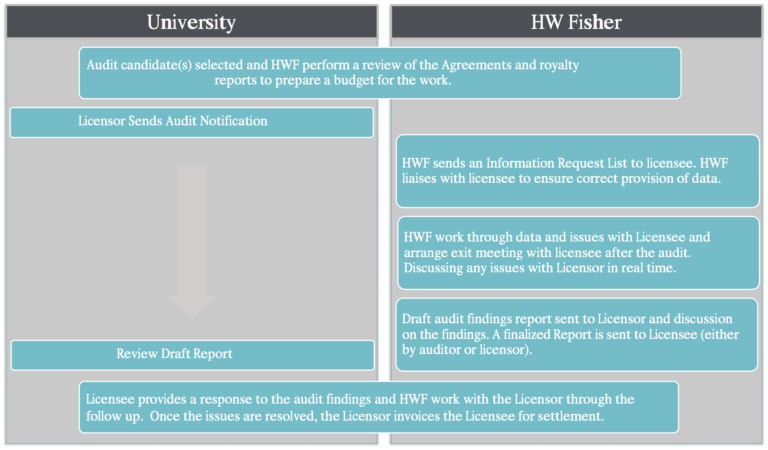

Some of our clients treat their audit programme as a matter of good governance, particularly if they have third party obligations. Other clients take a risk-based approach and ask us to focus our work on key risk areas to lower costs and maximise outcomes. In the final analysis, such programmes deliver a profit centre for the University and provide intelligence on how the IP is being used by the Licensee.

Our work with Licensees is, for the vast majority, a cooperative and non-adversarial process. Although some work is required of the Licensee in providing and explaining data, we find good business partners will always engage positively and work with the auditors to reach a successful conclusion to the audit.

We’ve included our typical approach below:

If you’d like to discuss your licensing programme – whether that’s negotiating a Net Sales clause or any other key clause with financial implications, managing your current portfolio or work on an Audit Programme directly – please get in touch.

We’d love to hear from you. To book an appointment or to find out more about our services: