14th January 2026

Ramsay Brown LLP is built on decades of medical industry experience, having supported thousands of professionals and organisations across the primary care sector, from GP…

7th January 2026

Dean Stevens and Rebecca Galbraith-Lowe announced as the firm’s two newest audit Partners Neil Maslen promoted to Director in HW Fisher’s private client tax team…

8th October 2025

HW Fisher, part of the Sumer Group, announces its acquisition of Media Marketing Compliance (MMC), an industry-leading firm enabling businesses to achieve financial transparency throughout…

10th September 2025

HW Fisher, part of the Sumer Group, a top 15 accountancy practice, is delighted to announce the appointment of Chris Wheeler as Partner in its…

21st November 2024

HW Fisher, part of Sumer Group, a top 15 accountancy practice, announces that it has appointed two new Directors to support the firm’s continued growth.…

10th October 2024

We’re delighted to announce that HW Fisher has joined forces with Sumer – a collaboration of renowned regional accountancy practices with a shared vision to…

13th May 2024

As of 1st May 2024, Martin Smith, Mark Reveley and Tanya Craft are partners in their respective departments, bringing the firm’s total to 28. Martin…

10th November 2023

HW Fisher, a UK top 30 audit and advisory firm, announces Sam Dewes’ promotion to Partner to support the firm’s continued growth. As part of the…

31st July 2023

HW Fisher, a UK top 30 audit and advisory firm, today announces the appointment of Andrew Tall as Corporate Tax Partner. Andrew is ACA and CTA…

27th April 2023

The Higher Education Policy Institute has published the first holistic picture of small and special-focus universities in Size is Everything: What small, specialist and practice-based…

23rd February 2023

We recently held a webinar on tax issues affecting the Not for Profit sector. This covered important issues on guidance and policy changes relating to…

6th December 2022

HW Fisher, a UK top 30 audit and advisory firm, announces that it has appointed two new Directors to support the firm’s continued growth. As part…

18th May 2022

HW Fisher, a UK top 30 audit and advisory firm, today announces the latest expansion of its senior leadership team to support the firm’s continued growth.…

14th December 2021

We recently held a webinar on tax matters for Finance Directors and Finance Teams at Not for Profit organisations. Specifically we focussed on: • A…

21st November 2021

With the festive season just around the corner, employers are looking to reward their staff following a year of hard work, whilst embracing the festivities.…

28th October 2021

This was a Budget set against a backdrop of the national debt. According to the ONS, the UK Government gross debt was £2.2 trillion at…

25th October 2021

The Autumn Budget is taking place on 27 October 2021 with Rishi Sunak setting out the Government’s spending and financial strategy. He is expected to…

19th October 2021

Update (29th October 2021): During the Autumn Budget 2021, the Chancellor announced that the Recovery Loan Scheme would be extended until 30 June 2022. From…

29th July 2021

A few years ago, I was lucky enough to spend a fair amount of time on the beautiful island of Barbados. So when the Barbados…

22nd July 2021

The Self-Employment Income Support Scheme (SEISS) grant has helped millions of self-employed people across the UK whose business and income has been affected by the…

7th July 2021

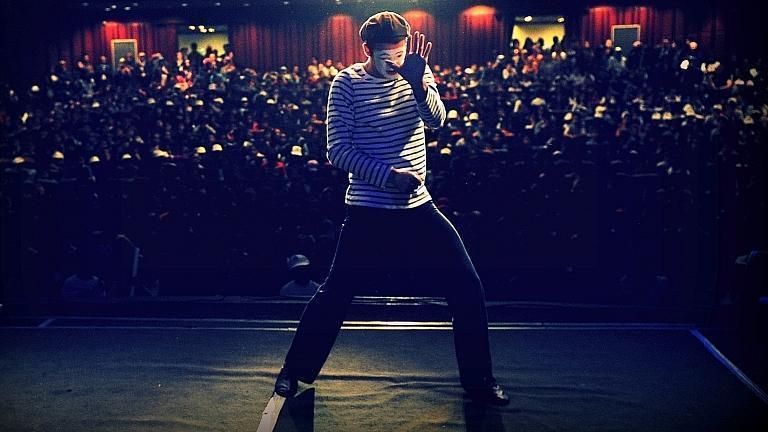

The Show Must Go On: Supporting Artists and Creating a Worldwide Arts Community through Digital Innovation Partner: Andrew Rich Client: VOCES8 Foundation In three sentences, what…

5th July 2021

We at HW Fisher are very sad to announce the untimely death of a much admired and respected former partner, Paul Beber, who worked with…

17th June 2021

To support businesses during the COVID-19 pandemic, the UK Government announced temporary changes to the VAT system. Many organisations took advantage of the VAT payment…

17th June 2021

Speaking on the Chancellor’s proposed plan to reject calls for an extension of the furlough scheme, Simon Michaels says “The Chancellor finds himself in the…

26th May 2021

MH Direkt, an Austrian owned e-commerce fulfilment business, has made its most recent e-commerce acquisition in the UK, acquiring Firebox.com, an online retailer of unusual…

25th May 2021

The Self-Employment Income Support Scheme (SEISS) grant has helped millions of self-employed people across the UK whose business and income has been affected by the…

14th May 2021

HW Fisher, a top 30 audit and advisory firm, has joined the WealthiHer Network as its latest partner. Founded in 2019 the Network is an…

5th May 2021

HW Fisher, the top 30 audit and advisory firm has today announced the hire of four external Partners as it continues its recruitment drive to…

28th April 2021

Storskogen, a Swedish privately owned company, has made its first acquisition in the UK, acquiring SGS Engineering – the leading e-commerce retailer of power tools…

21st April 2021

Ashtrom Properties UK acquired No. 8 First Street, a prime office development in Manchester – one of the largest single-asset transactions in Manchester for several years.…

20th April 2021

Over 1.4 million businesses took out a Bounce Back Loan last year. The scheme, which closed to applications on 31 March 2021, was heralded as a lifeline to…

7th April 2021

HW Fisher, the top 30 audit and advisory firm has bolstered its specialist Not for Profit team with the appointment of Carol Rudge as Head…

18th March 2021

Linda Plant is well-known for her no-nonsense business counsel on BBC’s The Apprentice, as one of Lord Sugar’s trusted advisors in the interview stage. With…

3rd March 2021

This Government has grappled with the largest deficit since World War Two and the need for a clear Covid recovery plan in this Budget. It…

2nd March 2021

HW Fisher, the top 30 audit and advisory firm has today announced the promotion of four new Partners to bolster its partnership team. As of…

29th January 2021

The landmark Business Interruption Insurance court case came to an end this month as the Supreme Court ruled in favour of small businesses forced to…

27th January 2021

HMRC has this week announced there will be no late filing penalty for those who file their self-assessment tax returns online by 28 February, removing…

11th January 2021

MagiClick, a leading provider of digital technology and design capabilities with a strong presence across Turkey and the MENA region, announces its acquisition of Dock9…

8th January 2021

After months of negotiations, the UK and European Union finally agreed a deal that will define their future relationship, which has come into effect as…

5th January 2021

On the 5th of January 2021, HMRC confirmed 55% of Self-Assessment customers have already filed their return. We are urging those who still haven’t completed…

5th January 2021

Commenting on the latest financial support measures announced by the Chancellor today, Russell Nathan, head of our Hospitality team says: “The latest support offered today…

15th December 2020

An unexpected crisis can dominate a charity and stagnate a charity’s activities. Knowing the essential steps in dealing with a crisis is important and can…

14th December 2020

2020 has been a year unlike any other. It has been a challenge for all of us, in all walks of professional and private lives,…

11th December 2020

The extension of the Self-Employment Income Support Scheme (SEISS) has been welcomed by many and will support small businesses until the end of the tax…

8th December 2020

It’s been a difficult year for our clients and friends in the hospitality industry. Businesses across the sector have had to push the boundaries of…

27th November 2020

Some good festive news to end on this month. There was some speculation that HMRC would not give the green light for UK employers to take advantage…

25th November 2020

With so many different loans and grants available to businesses during the Covid-19 pandemic there are many new challenges in how to account for the…

18th November 2020

Covid-19 changed the way we work overnight. And as we rapidly pivoted to working from home, the pandemic also changed the environment for criminals to…

11th November 2020

Following the announcement of a second lockdown, the government have announced an extension of the self-employed income support scheme. This scheme received praise during the…

5th November 2020

Commenting on the announcements made by The Chancellor on an extension to furlough today, Simon Michaels, partner at accountancy firm HW Fisher said: Businesses will…

5th November 2020

We have lost count of the number of changes and announcements from The Chancellor that have been made since March. With the support available in…

30th October 2020

As the Furlough period comes to an end, businesses in the hospitality sector will be taking a long hard look at their future. Despite a…

26th October 2020

The latest Government measures come just weeks after the Chancellor’s Winter Economy Plan and Extension to the Job Support Scheme. With the support available in…

22nd October 2020

Commenting on the revised measures announced by The Chancellor today, Simon Michaels, CEO of Business Solutions at accountancy firm HW Fisher said: “This is clearly…

15th October 2020

Commenting on the Tier 2 restrictions announced today, Russell Nathan, head of hospitality, said: “The tier 2 lockdown measures announced today will be catastrophic for…

14th October 2020

Two of the Covid-19 funding schemes introduced by government to support businesses are coming to an end, with claim deadlines approaching this month. The second…

14th October 2020

The new measures come just two weeks after the Chancellor’s Winter Economy Plan, where he announced the Job Support Scheme – billed at the time…

9th October 2020

Commenting on the announcements made by The Chancellor on furlough changes today, Russell Nathan, head of hospitality at accountancy firm HW Fisher said: “It’s a…

24th September 2020

Commenting on the announcements made by The Chancellor on a winter support package today, Simon Michaels, CEO of HW Fisher Business Solutions said: “It’s a…

23rd September 2020

Russell Nathan, hospitality expert at accountancy firm HW Fisher comments: “This announcement is another blow to the struggling hospitality industry, who have been patient and…

23rd September 2020

Among some of the various Covid-19 recovery schemes introduced by government to support businesses, is a new, little known, fund of £20 million from which…

15th September 2020

Commenting on the decision made by the High Court today on the landmark Business Interruption Insurance case, Rafi Saville, forensic partner at accountancy firm HW…

26th August 2020

Nearly 400,000 small businesses are waiting to see if insurers will be forced to pay out on their business interruption policies after a landmark High…

24th August 2020

The new VAT reverse charge for construction services comes into force on 1st March 2021. It applies to certain supplies of construction services by construction…

12th August 2020

As we enter the second half of 2020, it is important for charities to take stock of best practices, and to lay a strong foundation…

31st July 2020

The covid-19 pandemic has resulted in unprecedented financial challenges for businesses across the UK. For those in the hospitality and leisure industry, many have had…

30th July 2020

From August, The Eat Out to Help Out scheme will be introduced, however Russell Nathan, senior partner, explains why it might not be as popular…

30th July 2020

We’ve had false alarms from HMRC before but this time it looks as if they are serious. Making Tax Digital for Income Tax Self-Assessment (MTD…

29th July 2020

The reporting and payment of capital gains tax on disposals of UK residential property changed with effect from 6 April 2020. In practice, the change…

20th July 2020

If your business can’t wait until January for the retention bonus scheme, Simon Michaels, CEO of HW Fisher Business Solutions outlines what you can do…

15th July 2020

The Covid-19 pandemic has significantly affected corporate buy and sell activity worldwide, with the first quarter of 2020 cited as being down 25% on 2019…

15th July 2020

The Covid-19 pandemic has been a difficult time for many people, with the monotony of working from home, the anxieties and frustrations of childcare and…

8th July 2020

VAT should be reduced for the hospitality sector for a minimum of two years – January isn’t enough time to create long term certainty Our…

30th June 2020

2020 marked the beginning of what the UN called the decade of delivery, the 10 years where governments, institutions and individuals would work with intent…

25th June 2020

Russell Nathan, senior partner at top accountancy firm HW Fisher comments on the recent hospitality news: “Our restaurants, pubs, bars and hotels are struggling. Health…

25th June 2020

The Coronavirus Job Retention Scheme (CJRS) will enter its second phase on 1 July. From this date, it will be possible to “flexibly” furlough employees…

16th June 2020

HW Fisher, the top 30 chartered accountancy practice, has bolstered its corporate tax division with the appointment of Jason Steinberg as partner. Originally a trainee…

4th June 2020

The Charity Commission has provided guidance on what trustees need to consider in reporting serious incidents during and linked to the coronavirus pandemic. Having reviewed…

3rd June 2020

Along with an extension to the assistance for employers in the form of the flexible furlough scheme, the Chancellor has announced a second, if smaller,…

3rd June 2020

After weeks of supporting businesses through lockdown, the Government is now assisting employers in easing their employees back into work as the restrictions are relaxed.…

26th May 2020

It has been confirmed by the Treasury minister that organisations reimbursing staff for equipment purchased that enables them to work from home during the pandemic…

12th May 2020

Under the Coronavirus Job Retention Scheme, announced on 19 March 2020, the Government has put arrangements in place to provide grants to cover 80% of…

7th May 2020

Financial Support for the Retail Sector Client: Sole trader – designer Loan secured: £200,000 from HSBC through CBILS Approach: Through internal collaboration we were able…

4th May 2020

Originally announced by the Chancellor on 27 April, the Bounce Back Loan Scheme (BBLS) opened for applications on 4th May. This microloan is to help…

1st May 2020

HMRC has announced the temporary relief from VAT of Personal Protective Equipment (PPE). With effect from 1 May 2020, supplies of PPE will qualify to…

28th April 2020

The government has issued, and in some cases subsequently revised, measures to support SMEs during this time. Here, Simon Michaels and Jonathan Bourne answer some…

22nd April 2020

The Government has only recently issued its help package for the self-employed during the impact of Covid-19 and many questions remain outstanding. Our Partners have…

22nd April 2020

In the current circumstances we know a lot of charities are having to change the way they operate to ensure fundraising and funding can continue…

22nd April 2020

On 20 April 2020 the Government announced a support package for innovative firms facing financing difficulties due to the coronavirus outbreak. The new package includes:…

21st April 2020

Helping the Retail Industry Keep Up-to-Date and Make Well-Informed Decisions for the Future Partner: Ross Fabian Client: European distributor for a sports footwear brand Advising…

20th April 2020

20 April 2020 The Government’s Coronavirus Large Business Interruption Loan Scheme (CLBILS) launched officially on 20 April 2020. Originally announced by the Chancellor on 2…

9th April 2020

In the current circumstances we know a lot of charities are having to change the way they operate to ensure fundraising and funding can continue.…

9th April 2020

The uncertainty surrounding Covid-19 has huge implications on financial reporting. All company directors have a responsibility to prepare financial statements that give a true and…

8th April 2020

Preparing to Keep a Healthcare Company Afloat in the Absence of Patients Partner: Joel Courts Client: Dental sector Advising on: Coronavirus Business Interruption Loan Scheme…

31st March 2020

You can use this scheme if you’re self-employed as an individual or in a partnership and have lost income because of coronavirus. You can apply…

31st March 2020

You can use this scheme if you’re self-employed as an individual or in a partnership and have lost income because of coronavirus. You can apply…

30th March 2020

You can use this scheme if you’re self-employed as an individual or in a partnership and have lost income because of coronavirus. You can apply…

28th March 2020

Over the past few weeks, the UK Government has announced a host of packages to support individuals and businesses through the impacts felt by the…

27th March 2020

Who is eligible for the support? Despite the Chancellor’s saying that the package for the self-employed provides parity with employees, there are some very material…

This website uses cookies to improve your experience. We'll assume you're ok with this, but you can opt-out if you wish.AcceptReject Read More Privacy & Cookies Policy